Market Summary

Welcome to the AI Options Trading Platform. Our AI system identifies high-probability sell put opportunities based on market conditions.

Current AI Recommendation: Consider selling put options on current stock.

Top Opportunities

| Strike | Exp | Premium | AI Score | Action |

|---|

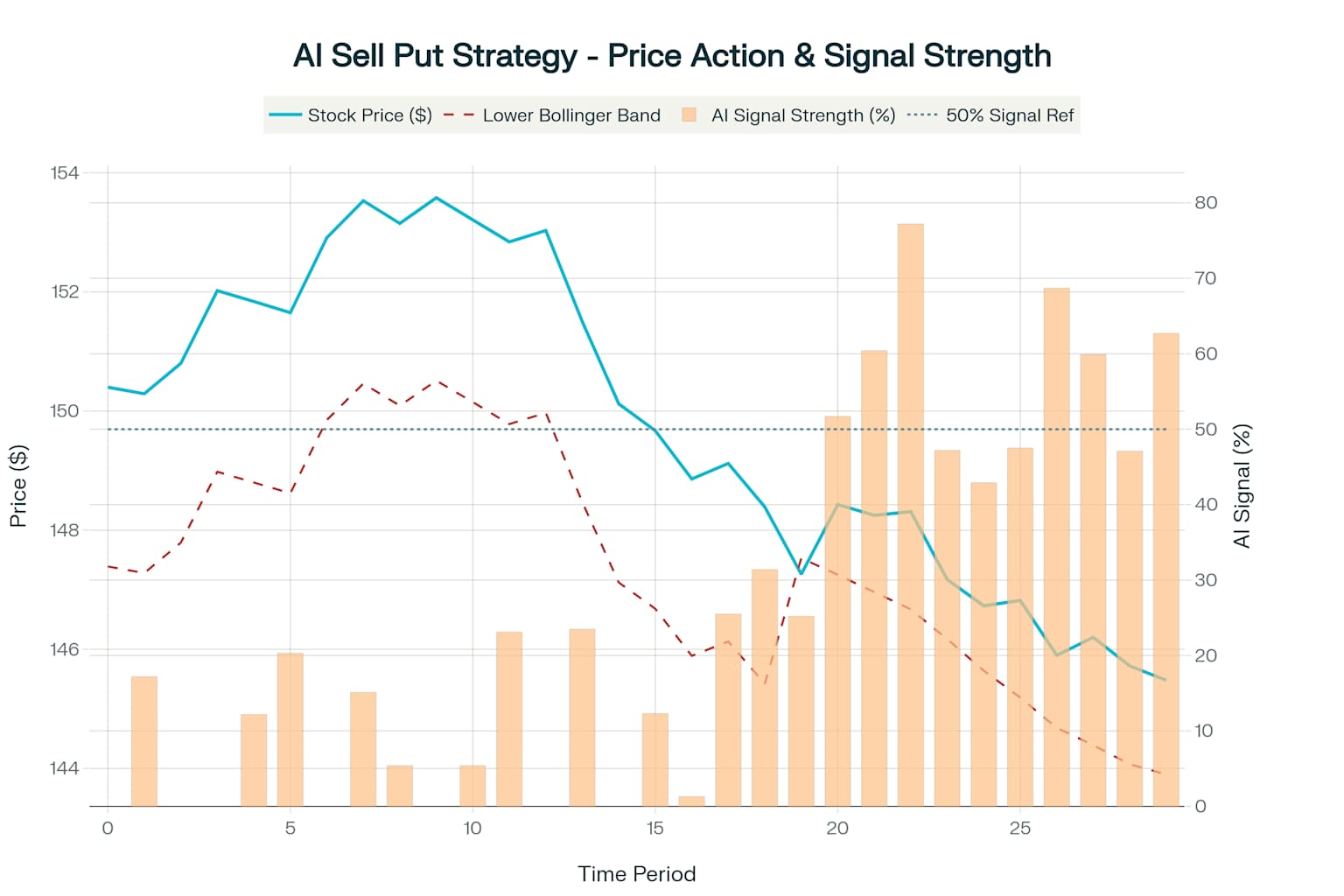

Market Trend

AI-Recommended Put Options

| Strike Price | Expiration | DTE | Premium | IV | AI Score | Risk | Action |

|---|

AI Signal Interpretation

AI scores are calculated using a combination of technical indicators, volatility measures, and historical performance patterns. The AI evaluates multiple factors including:

- Strike price distance from current price

- Implied volatility levels relative to historical averages

- Recent price momentum and support/resistance levels

- Time to expiration and theta decay potential

Put Options Chain

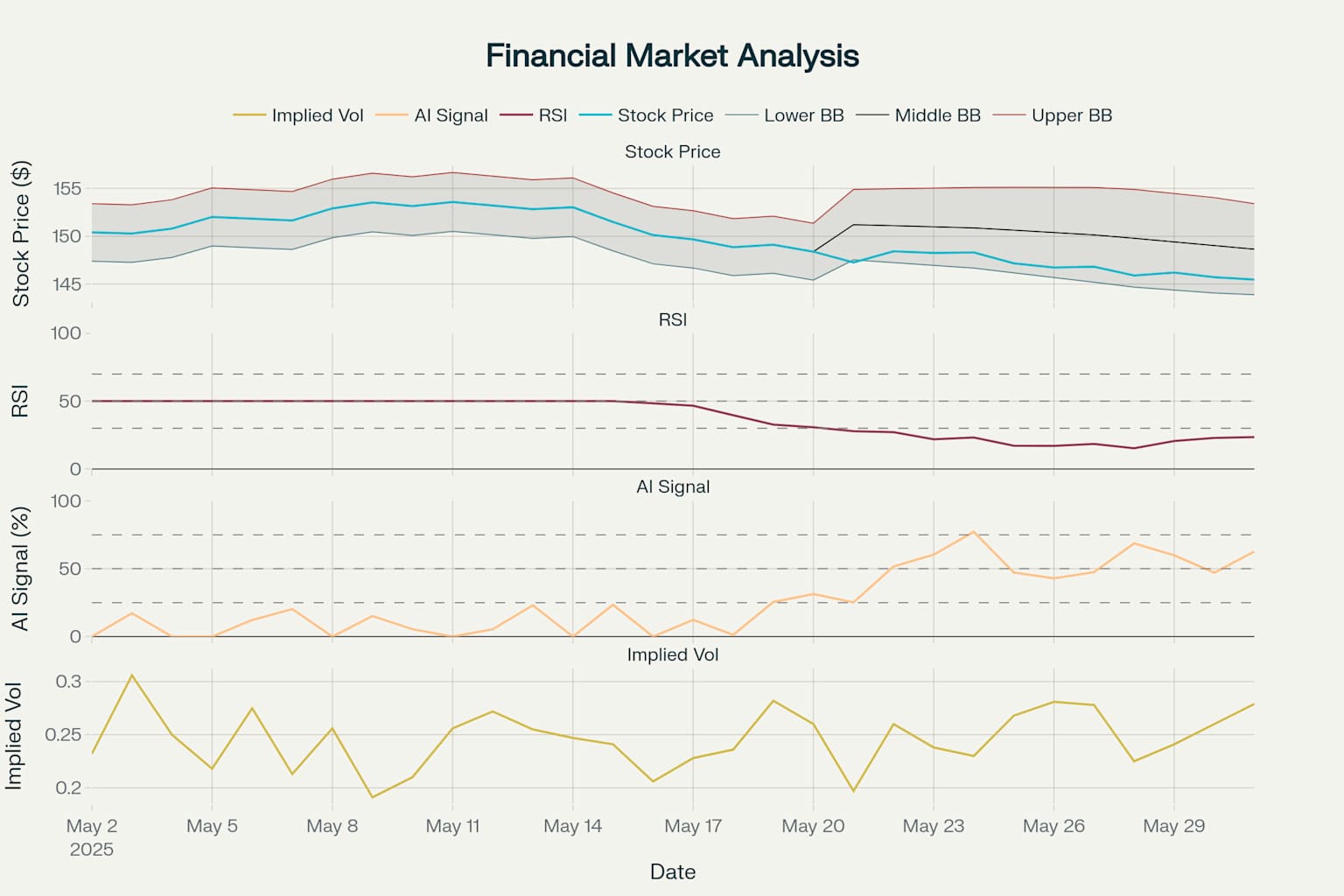

Technical Analysis

Momentum Indicators

Volatility Indicators

AI Analysis Summary

The stock is currently trading near its lower Bollinger Band with an RSI of 35.41, suggesting it may be approaching oversold territory. This creates a favorable environment for selling put options as the stock is likely to find support at these levels.

The current implied volatility of 24.8% is moderately high, offering attractive premiums for put sellers while maintaining a reasonable risk profile.

Cash-Secured Put Calculator

Strategy Results

Scenario Analysis

| Price at Expiration | Outcome | P/L |

|---|